February 2012: After a lurching rise, then fall, of U.S. middle market M&A transactions in 2011, we expect key factors to fuel increasing activity in 2012. The prevalence of idle cash on hand, a pent-up demand for high-performing acquisition candidates, and the likely capital gains tax increase will all serve as drivers. Savvy business owners will view the next 12 months as a highly strategic window of opportunity for planning and action, regardless of whether they consider buying, selling, holding or transferring.

Optimism for the Long-Term

As 2011 closed, the pace of transaction activity slowed in the middle market. There was a 22% year over year drop in the number of reported M&A transactions from 2010 to 2011 for companies with annual revenue ranging from $10 to $250 million. Since late 2011, much media attention has focused on this fall-off.

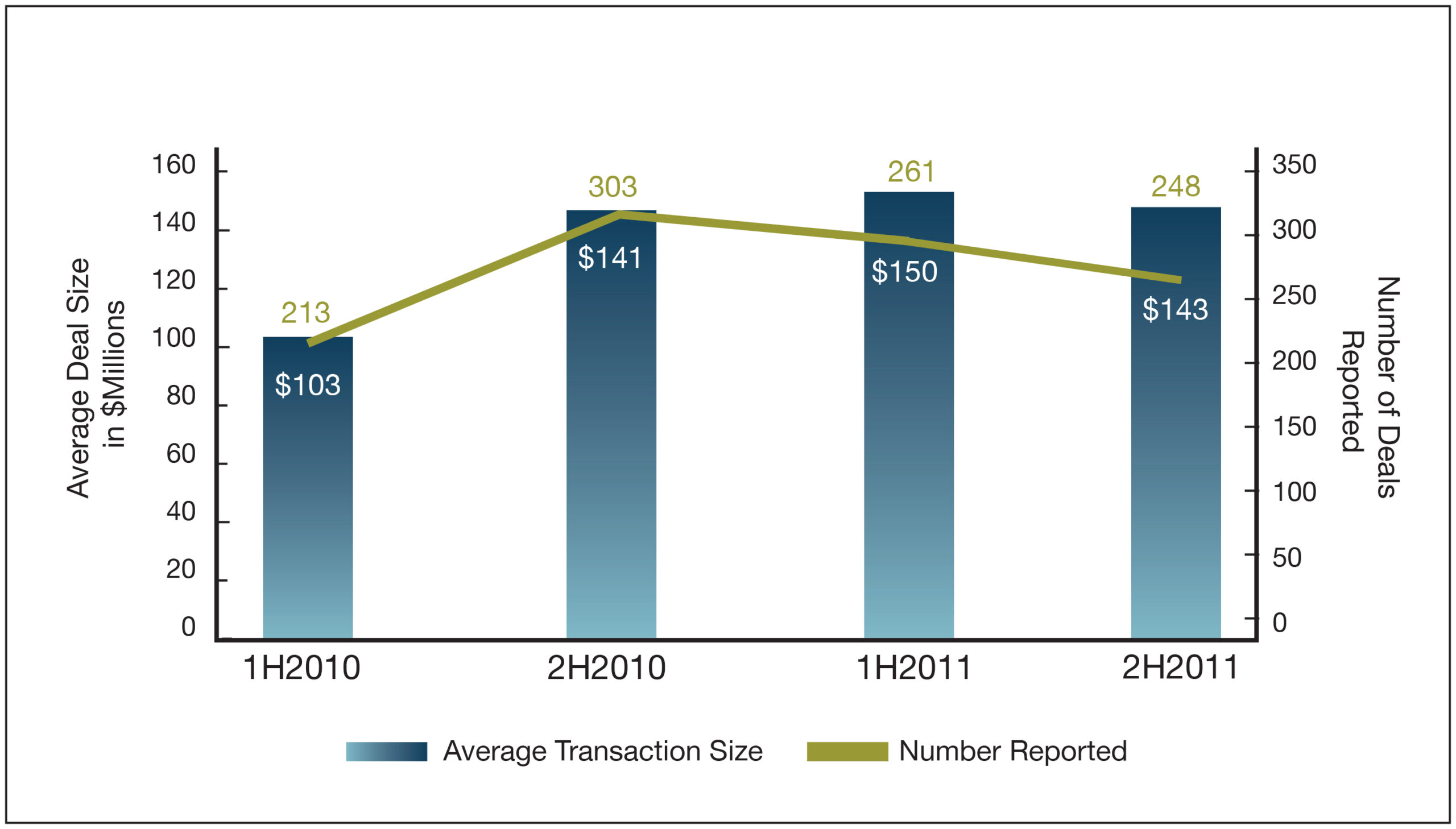

However, a broader view is more relevant. From January 2010 through December 2011, the value of these reported transactions for mid-sized companies trended slightly higher overall, as seen in Figure 1. Average deal size in the lower middle market category climbed from $103 million in the first half of 2010, topping $150 million, before settling at $143 million by December 2011. Valuation multiples in 2011 hovered in the range of 5-7x EBITDA for most mid-sized companies, with higher outliers seen in unique, niche markets.

(c) 2012 DAK, Ltd.

The sway of transaction activity throughout the interim months of 2010- 2011 may more accurately reflect the inflated rush of owners looking to sell before year-end 2010 to avoid anticipated higher long-term capital gains taxes. It also indicates that many sellers may have chosen to thoughtfully wait out the market in 2011 – as we counseled in specific cases – to better optimize their value in 2012.

Given the scarcity of good acquisition candidates, we remain optimistic. We anticipate continued demand resulting in measured improvement in offering prices. Additionally, as companies regain operating strength, we may see a decrease in the number of companies in financial distress. This, too, should support a rise in average valuation.

Cash on hand drives demand

Near the end of 2011, cash levels of the S&P 500 topped $2 trillion, at the time of this writing. Many of these companies will seek to mobilize their cash positions through acquisitions to satisfy their need to demonstrate the returns stakeholders expect from an equity investment.

In addition, private equity (PE) investors still have huge amounts of cash on hand seeking deployment – nearly $425 billion at the end of 2011. Not only do many PE funds have cash remaining, several continue to raise new money, ready for investment. The middle market has yet to see the full benefit of deployment of this cash.

Appeal of the middle market

Mid-sized companies remain particularly enticing to investors and corporate buyers. To illustrate, middle market deals under $500 million accounted for nearly 85% of all private equity investment in the U.S. in 2011. Nearly 50% of these PE acquisitions comprised add-on complements to existing holdings within the investment platform, representing an historical increase and mirroring current corporate buying strategies.

With a median add-on transaction size of $80 million, it is clear that the middle market represents a highly attractive source for execution of strategic mandates. This reinforces our staunch belief that lower middle market businesses represent great value, potential for synergies, and sources of new technology and innovation for both private equity investors and corporations.

In 2011, roughly 21% of all lower middle market deals occurred within the industrial category. We expect a continued focus on M&A within key industrial sectors ripe for growth or consolidation.

(c) 2012 DAK, Ltd.

Tax law considerations will prompt action

Pending an act of Congress – which many experts perceive as highly unlikely during the presidential election cycle – favorable tax laws are expected to sunset by the end of 2012, providing a short window of opportunity to enact wealth transfer and estate and tax planning options for business owners.

In 2013, the capital gains rate will return to 20% unless Congress acts. Qualified dividends would climb from the current maximum of 15% to the highest income tax rate, projected to be 39.6%.

Additionally, the gift tax exemption level, now currently at $5 million, would drop to $1 million in 2013. Several strategies can be adopted this year, including the use of grantor trusts, to maximize the value of that exemption for a business owner concerned about preserving wealth for his or her family.

Themes and Trends for 2012

After what many considered a year of re-building, corporate buyers and investors are clamoring for acquisition opportunities. Business owners report receiving aggressive, unsolicited offers for their companies. Managing such bids and evaluating offers has become a top M&A concern for management teams.

For leveraged buy-outs, transaction structures are also displaying higher amounts of equity investment to mitigate the risk of debt financing. The vetting process is becoming increasingly more thorough and complex, with greater attention paid to fluctuation and minor sensitivities of financial models. And, financing, while certainly available, is restrained. It will take more finesse and a specific, optimal match of borrower to lender to secure appropriate financing. While the resources are there, the process is becoming more complex and thorough in response to market sensitivities.

Strategic buyers flush with cash and enjoying relatively low borrowing costs likely will benefit from the opportunity to deploy their money thoughtfully. Feeling the pressure to stimulate new growth, many business owners have recognized that pursuing an acquisition strategy will deliver faster results than attempting to grow organically. Companies that had cut back on R&D during the recession may now be exploring alternative sources of innovation. These buyers seeking strategic complements for their product lines or service offerings remain the greatest impetus for mid-market activity.

Opportunities for cross-selling and expansion of geographic territories will continue to stimulate cross-border M&A transactions. Foreign interest in U.S. markets remains strong.

Finally, while we may see fewer companies in financial or operating distress, there is still the potential for an increase in distressed company sales. In a stronger market environment, banks and other lenders may be less willing to amend and extend loan agreements, and more inclined to encourage underperformers to pursue an outright sale to satisfy debt.

Market conditions offer strategic opportunities

As many favorable factors and conditions coincide to support acquisitions as well as exit strategies, we strongly urge business owners to review their strategic plans for 2012. Short-term opportunities exist for the creation and implementation of value-maximizing strategies. Ask yourself the following questions:

Key questions to consider for 2012 strategic planning:

- If approached to sell your company today, are you positioned to elicit the best offer? Start a discussion with a strategic advisor.

- Have you vetted your own business from the perspective of a buyer to identify areas worth a premium, not a discount? Undertake improvements, as identified.

- Can you successfully grow your company in time to take advantage of market opportunities? Consider a strategy of growth through acquisition.

- Have you recently reviewed your estate planning options? Explore the possible benefits of taking advantage of a potentially expiring $5 million gift tax exemption.

- Are you getting the risk adjusted returns from your company you would expect from other holdings in your portfolio? View your company as your largest financial asset and consider its effect on your total holdings.

View/save this article: The_DAK_Group_M&A_Update_Winter 2012